By Tony Kaye, Senior Personal Finance Writer, Vanguard Australia

As an investor, it can be worrying when returns move into negative territory.

Many of us are used to seeing that with share investments, but it’s less common when it comes to high-quality, investment grade bonds.

In recent months, however, that’s exactly what’s been happening with bonds. The prices on government bonds, which are generally regarded as relatively risk-free investment securities, have been falling.

This comes at a time when the income returns from government bonds remain quite low.

So, why have the trading prices of bonds (fixed interest securities) been falling on markets?

What’s actually happening with bond prices at the moment is being driven by rising growth and future growth expectations across developed economies such as Australia.

Governments around the world have been stimulating growth by pumping huge amounts of capital into their economies to counter the debilitating financial effects of the COVID-19 pandemic.

But a counter effect of doing this is that if economic growth moves too quickly it can lead to higher inflation.

This may then require central banks such as our Reserve Bank to lift official interest rates to ensure the economy doesn’t become too overheated.

While central banks have poured cold water over the prospects of official rates rising anytime soon, it’s these expectations that have driven a rise in government bond yields.

And that’s resulted in a corresponding fall in bond market prices.

Are negative bond returns a concern?

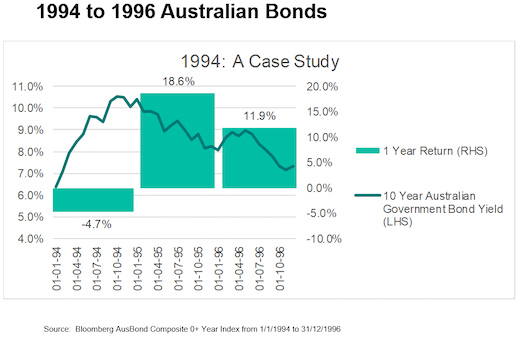

Negative price returns from bonds are certainly nothing new and, to illustrate that, it’s useful to look back to historical events between 1994 and 1996.

As shown in the chart below, Australian 10-year bond returns fell into negative territory in 1994 as bond yields (interest rates) rose. But, over the course of 1995 and 1996, bond returns rose sharply as yields declined from their peak above 10 per cent.

Bond yields are shown on the green line and left-hand axis, and annualised bond performance is shown on the three green bars.

While there is less scope for a sharp fall in bond yields as experienced in 1995 and 1996 given the current overall lower yield environment, it’s still important to focus on the role of having fixed income (bonds) in a diversified portfolio.

Understanding the role of bonds

On a risk-return basis, bonds sit below shares and above cash.

Equity market returns have been rising strongly over the past year since the huge sell-offs on global share markets in February-March last year.

With the strong growth comes a higher element of risk.

Being lower risk than shares, bond returns are generally expected to underperform shares over the long term.

Likewise, being slightly higher risk than cash held in savings and term deposit accounts, bonds are generally expected to outperform cash over the long term.

It’s important to understand that one of the key roles of bonds in an investment portfolio is to offset the higher risk inherent in shares.

Bond returns tend to move in the opposite direction to shares and play a valuable role in protecting near-term downside risk when the share market performs worse than expected over short periods. They tend to act as a buffer to volatility in shares.

In other words, they provide asset class diversification to help smooth out total investment returns over time.

While bonds do not generally outperform riskier asset classes such as shares over the long run, they have a more stable return profile.

In addition, having exposure to bonds with longer maturity dates (for example, 10-year bonds and longer) than shorter-term securities (one year or less) provides further protection, because longer-term securities tend to perform better when equities perform poorly.

This introduces the benefits of investing into bond index funds, which have holdings in a wide range of bond issues that have different maturity dates.

As individual bond issues reach their maturity date over time, investments can be purchased in new bond issues with higher yields. This increases the prospects for future income.

Investing in bonds during a time of rising yields, as we’re seeing now, will deliver higher income returns. This may be attractive to those seeking higher income in the future.

While seeing a negative price return from fixed interest securities is not overly common, keep in mind that asset class returns do invariably change on a continual basis.

Having broad exposure to the stronger performance from equities will deliver growing investment returns over time and provide diversification.

But if there are events that cause a sharp fall on equity markets, as we experienced last year, a flight to safe and quality investments, such as government bonds, will continue to reduce portfolio volatility.

Your overall portfolio allocation to different assets ultimately comes back to your investment goals and risk profile, and more specifically to your overall time frame.

An iteration of this article was first published in Canstar on 23 March 2021.

Speak to us on Phone (02) 9436 2301.

Source: Vanguard https://www.vanguard.com.au/personal/education-centre/en/insights-article/bonds-still-adds-up

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2021 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.